Throughout the effects of Covid-19 in New Zealand, and across the world, the logistics industry has played a key role, finding itself in the provision of an essential service.

Proving that even when the world comes to a grinding halt, people still need (and expect) their deliveries, logistics companies have helped ensure the global flow of goods during a unique time in our history.

While we watch the global health community battle through their determined response to Covid-19, we have also witnessed every aspect of the economy deal with, and react to, its own challenges. Global logistics is no exception. For DHL Express, despite a 94% transit time for delivery during Covid-19, there have been learnings from efforts to stay ahead of the global pandemic.

So as some restrictions begin to ease and we breathe new life into the economy in so many regions of the world, there is a perfect opportunity to step back and establish a first retrospective summary of what the industry has been through, and how we can learn from it.

DHL Express has partnered with Richard Wilding, professor of Supply Chain Strategy at Cranfield University in the UK to look at ways of delivering pandemic resilience, with the research identifying critical pain points along the Covid-19 supply chain and providing a framework to tackle future emergencies.

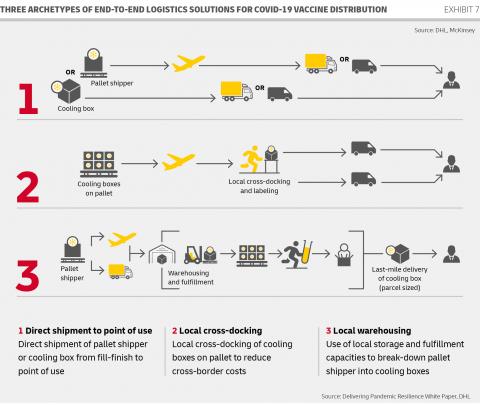

The partnership resulted in a white paper that analyzes the impact of COVID-19 and provides several strategies to set up supply chains of the future, of which logistics companies will play a key part. Some of the topline findings are; to initiate immediate public and private sector discussions to prepare for the challenge of COVID-19 vaccine logistics, and to provide our customers, governments and NGOs with the learnings of this pandemic and a framework to tackle future emergencies.

Based on real life cases, the paper outlines possible scenarios for how the logistics industry could transition to a new normal from the current pandemic status quo.

Looking ahead, industries and supply chains will not be the same post-coronavirus as they were before. With scientists searching diligently for a vaccine against the disease and many businesses still managing the crisis, any iteration of normalcy is still a distant goal. In the meantime, an interim phase – the pre-new normal – will bridge the gap between lockdown and the new normal. Obviously, some industries were hit harder by the pandemic than others and thus will recover more slowly. In the ‘pre-new normal’ phase, resilience, demand, transportation, warehousing-related topics, and workplace operational practices will become critical issues.

“The photographs and TV images were stark. Long before countries went into lockdown, their supermarket shelves were stripped bare. Pasta, toilet paper, rice, painkillers, canned tomatoes, flour – all gone. Factories and distribution have a delayed reaction to extreme fluctuations in demand. In the end, fear of lockdown-induced supply chain disruption was no longer the trigger. People were panic-buying because other people were panic-buying,” explains Richard Wilding, professor of Supply Chain Strategy at Cranfield University.

In the new normal, if your supply chain is the same as the one that you had pre-coronavirus, you’re probably doing something wrong.

In this pre-new normal world, supply chains will be reshaped to make them more resilient. In New Zealand over the last few months there have been multiple adaptations in order to better operate in a new reality. Before the onset of Covid-19, DHL Express would operate its B767 Trans-Tasman Freighter five times a week, to and from Australia, but with the increase in deliveries over the lockdown period, DHL used its capabilities to increase the rotations to twice daily, seven days a week.

As demand has become more volatile and consumer tastes and needs erratically fluctuate, there has been an increase in the need for flexible and alternative transportation flows and warehouse networks. While online shopping will be more prevalent and direct-to-consumer sales will increase, other retail channels and industries will be disrupted. These are just some of the facets that influence modern supply chains.

For instance, DHL Express has seen a large increase in deliveries of sanitiser, PPE masks and cosmetics. With local stores closed during NZ Alert Level 4, New Zealanders have shipped in these items from overseas as much needed essentials.

Finally, configuring post‑coronavirus workplaces to meet social distancing and sanitation guidelines will also affect the work styles in both warehouses and offices. Just as procuring for resilience will become an increased focus, remote working will disrupt established processes, providing fresh impetus for digitalization and automation initiatives.

Supply chains will re-shape themselves around resilience, with more diversified manufacturing, and multiple sources of supply. While supply chain innovation will be essential, collaboration along the value chain will be the enabler for future business success. Most of the current pandemic learnings and future implications will lead to a much more important role for supply chain management and logistics. The world is changing, and businesses - including supply chains - must change with it.