An effective Intangible Asset strategy can make or break you in the US market - as Paul Adams explains.

Landing in the United States for the first time in my early teens the first word that popped into my head was “big”. The cars were big, the houses were big, the cities were big. The US is a big market and a big opportunity. Businesses which successfully navigate this market can generate outsized returns: it’s common for a single customer to eclipse an entire years’ revenue from the New Zealand, Australian or Singaporean markets.

However, bigger opportunity brings bigger risks and bigger obstacles. One of the most important risks many companies fail to manage (or even identify) when entering the US is intellectual property and intangible asset risk.

What are intangible assets and risks?

Intangible assets include all the assets in a business you can’t stub your toe on: data, software code, content, brands, regulatory approvals, product designs, inventions. These assets account for over 87% of all company value today. Despite being so important you won’t find them on your balance sheet and often they are an afterthought: companies tend to focus on their physical products or services not the intangible assets that underpin them.

Why are intangible assets important when entering the US?

Neglecting or failing to understand intangible asset risk is an extremely dangerous strategy (or lack of one) when entering the US. Here are just some of the reasons:

• There are far more active patents in the US than any other major market (about 25% of all patents in the world are in filed into just this one market). This dramatically increases infringement risk.

• The US is the most important technology market in the world. Companies from all over the world come to the US (Korean, British, Chinese, Indian, Middle Eastern, Brazilian etc) – all with their own intangible assets. So it’s not just the natives you have to worry about, it’s the tourists too.

• Competitors are larger, better resourced and far more aware of intangible assets. Competition is intense.

• The market is more mature and the service providers (lawyers etc) are more capable and more aggressive;

• Lawsuits to enforce intangible assets are far more common (there were approximately 6,000 patent infringement law suits alone in the US last year, compared to a few dozen or low single digits in New Zealand or Australia for example);

• These lawsuits are extremely expensive to defend (median costs are US$5M and there is the risk of extremely large damages awards; and

• Companies are more aggressive – in business, in technology and in legal culture - they are far more likely to play “hard ball” (they invented the game after all) and will not hesitate to attempt to replicate technology if possible and / or to launch litigation.

In many ways the US is the spiritual home of intangible assets. It’s no coincidence that many of the world’s most successful, fastest growing and most aggressive companies are intangible asset companies (Google, FaceBook, Intel, Microsoft, Amazon, Apple to name a few) grew up in the intangible asset rich environment of the US. They owe their success to a deep understanding of the enormous power of intangible assets to drive growth and they take them very seriously. This contrasts sharply with companies from Asia-Pacific who tend to see intangible assets as being irrelevant or just “what we do to get to the products we make.”

In short Intangible Assets are mission critical for any company entering or expanding in the US.

Two Core Intangible Asset Risks

The core intangible asset risks when entering the US break into two groups:

1. The risk of having your innovation or product rapidly copied by aggressive competitors

2. The risk of being sued by someone who has superior intangible assets relating to your products or services.

Let’s look at both these in a little more detail.

They will only pay for what they cannot steal

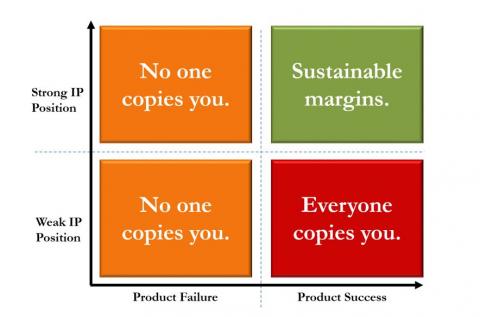

It’s a brutal truth and it applies the world over, but it’s an especially important lesson when entering the US: if you are unable to defend your new [enter your product/service/innovation name] and it is successful then it will be quickly copied. The diagram below explains why.

If your product is a failure no one will copy you (regardless of the strength of your intangible assets). However if your product/technology/innovation/service is a success, but has a weak intangible asset position then there is little to stop others from copying it. This eats away at market share and eventually leads to subsistence margins as more and larger competitors enter and compete on volume and price.

Unfortunately the bigger the opportunity, the bigger the incentive to steal.

On the other hand if you have a successful product/technology/innovation/service protected by a strong Intangible Asset position it becomes much more difficult and risky to copy you. Reduced direct competition leads to increased market share which drives higher revenue and/or higher margins which builds profit and increased return on investment. This is why your business’ Intangible Asset position is so strongly linked with business success in the US.

Even if you don’t care about Intangible Assets, you can guarantee someone in the US cares very deeply.

The second risk revolves around risk of being sued by someone who has superior intangible assets relating to your products or services. Perhaps you don’t care about intangible assets and never bothered to protect your product or, maybe the opposite, perhaps your product is extremely well protected, however in either case you can still infringe someone else’s intangible assets. In other words regardless of your own intangible assets you can still be sued.

The intangible asset environment has fundamentally changed in the last five years. Already regarded as a particularly litigious market, in recent years there has been exponential growth in intangible asset litigation in the US. Whereas previously it did not make sense to sue a company that had revenues under $200M (ensuring most Australasian companies could fly under the radar), the litigation floor has now collapsed to as low as $5M.

This change has been driven by a number of factors:

• Technology convergence has broadcast risk – key intangible assets owners are now often not from your industry;

• The Internet – makes it easier to find/analyse people using US-owned Intangible Assets - there is no hiding;

• Globalisation – in increasingly interconnected world threats can come from anywhere;

• Increasing intangible assets liquidity – it is easier to buy, sell, finance intangible assets;

• Industrials / tech companies driven by shareholder activism are starting to litigate with their huge intangible assets portfolios or outsourcing enforcement to non-practicing entities or patent trolls (see below);

• Hedge funds now actively financing intangible assets litigation; and

• The rise of “patent trolls”.

Trolls Under the Bridge

A patent troll is an entity that owns intangible assets (typically patents) and earns revenue via litigation or licensing. Trolls exist ONLY to litigate, meaning they can only survive if they are actively suing people.

The following is a checklist of preferred Troll targets:

• You have between $5M-$200M in revenue (large enough to have money, too small to fight back effectively;

• You are in the midst of some major business event (pre-IPO, major capital events (investment, loans), new entrants to markets, immediately post float); and

• You are getting increasingly more successful / high profile.

Unfortunately, if this sounds like you or is likely to apply to you in the near future, you are at a substantially increased risk of being sued. In many cases it is a matter of when, not if. Sticking your head in the sand does not fix the problem and solving the problem after it happens (as outlined above) is extremely expensive.

Other consequences include injunctions against selling product, product seizure or recall, trade show booth shutdown and damages. It is worth noting that managers and directors can be directly liable for failing to manage infringement risk. This is not a remote risk either. Below are few examples of successful Australasian businesses who that have been recently burnt in the US:

• Well known company was sued three times in four weeks following acquisition by a US company;

• Technology company spent $NZ15M defending an infringement suit before settling and paying licensing fees; and

• Company was effectively forcibly acquired following patent litigation by an offshore competitor resulting in major destruction in shareholder value.

If you fail to plan you plan to fail

When entering the US companies need to take proactive steps to protect their innovations and reduce or mitigate their intangible asset risk. In short you need to have an effective Intangible Asset strategy.

Unfortunately many Asia-Pacific companies entering the US spend little or nothing on intangible asset strategy or rely on the “free” IP strategy provided by their patent attorney.

Unfortunately, as with most things in life – you get what you pay for: many “IP Strategies” provided by patent attorneys are essentially just a patent and trademark filing strategy. This in no way prepares a company for entry to the US and can lead to filing for expensive assets that provide little effective protection. Many companies do not understand that in terms of both volume and value, the majority of the intangible assets in most companies are located not in patents and trademarks but in confidential information, know-how and copyright. Therefore focusing solely on patents and trademarks is a major error. At the very least your intangible asset strategy should be set by someone other than the person filing, or benefitting from filing, your patents and trademarks.

In summary intangible assets are critical to successful US entry and expansion strategy. Intangible assets when utilised correctly, can dramatically increase value and act as a key defence against margin and market share erosion. It also cannot be ignored: you can guarantee someone in your industry is taking intangible assets very seriously: boards and senior management teams have a fundamental responsibility to identify, manage and mitigate all risks and that includes intangible asset risk. Intangible asset strategy should be independent. It is fundamentally about business, financial and strategic decisions rather than filing patents and trademarks.

The key takeaway: effective Intangible Asset strategy can make or break you in the US.

Paul Adams is CEO of EverEdge Global, a global advisory and transaction firm that assists companies and investors to unlock the value of intangible assets and reduce risk. Paul has been named one of the World’s top IP strategists the last five consecutive years and was the recipient of the Outstanding IP Leader Award 2012. www.everedgeglobal.com.