Factoring can be a quick way to ease tight cash flow, but it comes with a cost and there is a gap in global factoring coverage for emerging markets such as China.BY MARY MACKINVEN

Outsourcing debt collection frees up small to medium-size companies to focus on core business, but it is only appropriate in certain circumstances, says M-Com sales and marketing manager Serge van Dam.

“Factoring, or selling your accounts receivable to a third party is not relevant to us because we have a small number of customers with a high degree of intimacy,” van Dam says.

M-Com invoices 20-40 organisations a month. Customers are big banks operating on five continents. They take time to pay.

“Banks and big companies take a relaxed view of paying on time, even though contracts have punitive clauses such as interest for late payments.”

He says banks go through multiple layers of approvals for payment, hence pay a month or two late — but they do pay. Even so, late payments are an issue.

“You have to keep significant reserves in the bank for customers that don’t pay. And each order is worth hundreds of thousands of dollars.”

A growing company, M-Com needs all the cash it can get to expand.

Factoring feels inappropriate for the company and would be used only as a last resort, van Dam says.

“I know the person who authorises the payment so getting that third party to chase the person would be weird. The factoring company might yell and swear at them; threaten to put a horse’s head in their bed — I’m joking. It could adversely impact our relationship with our customer long term.”

But he can see benefits. “Factoring makes sense for someone with a significant cash flow problem or no intimate relationship with a large set of customers; for example, if they sell to 200,000 people online each month.

“If you sell to lots of different distributors in lots of countries and chasing debt is not your core business — it’s time consuming, disruptive and irritating — maybe it’s not even economically viable to do it yourself.”

BENEFITS

Companies should try factoring before they get to the point of debt write-off because by then not even factoring will work, says Simon Thompson, Lock Finance’s chief executive.

Lock can provide access to cash tied up in the debtors’ ledger, providing up to 90% of each debtor’s face value within 24 hours.

In addition, Lock manages the accounts receivable, so precious time is not wasted chasing customer payments.

When Lock receives full payment a company receives the remaining funds. A certain portion, typically 12-15%, is deducted as the cost of providing the debtor administration service, Thompson says.

Lock’s service has mostly been used for local business.

It takes time for people to get used to the concept, Thompson says. “We are trying to find people that it suits.

“It’s easier for us if the company has a spread of debtors compared with a single risk, and exports to countries where regular debt procedures are enforceable [for ease of collection].”

Lock is working with the International Factors Group (IFG) as a partner company to collect invoices for overseas deals. IFG has extensive networks, with members in Europe, Russia and some Asian banks.

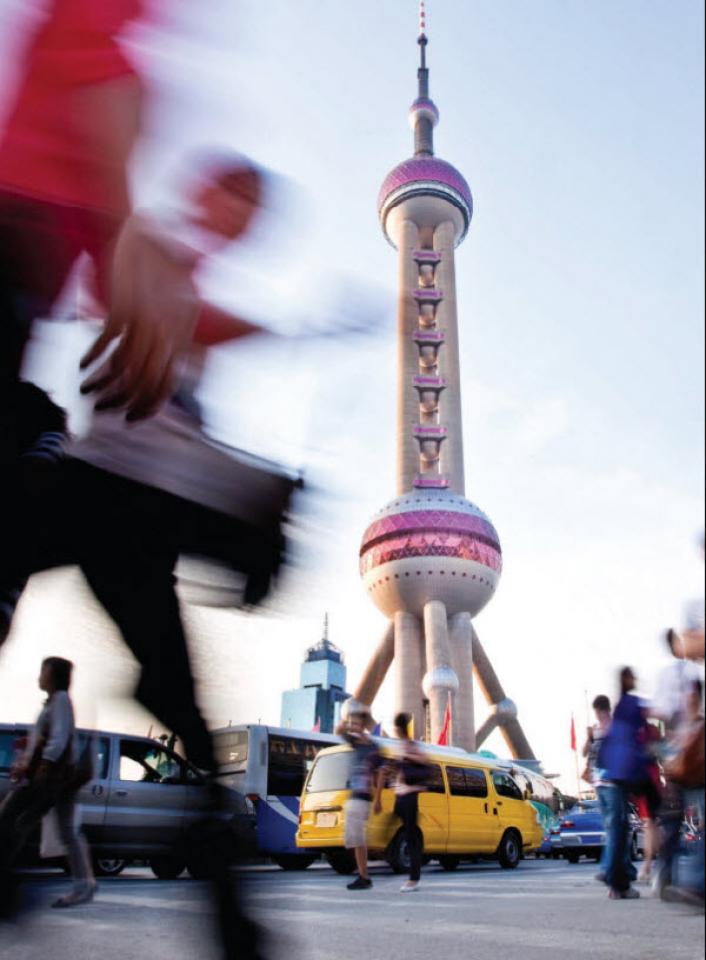

“There are a lot of exports to China, but it’s harder to find parties — banks, finance companies — to take the country risk there,” Thompson says.

WHEN LCS DON’T COME EASY

Thompson says factoring is often cheaper than a letter of credit (LC), or an alternative if a business can’t get an LC.

“It’s a form of pre-shipment finance. Invoices are already in motion. We also work off purchase orders to fund exciting projects.

“If you have a lot of working capital, that’s good, but credit markets have tightened up and you have to put property up for security.

But you can use your assets on your balance sheet – accounts receivable.

“It’s not a long-term solution, but to get you through a growth phase.”

Needing to raise cash flow quickly is a foreign concept to GMP Pharmaceuticals, a winner of the New Zealand Trade and Enterprise International Business Awards and contract manufacturer of supplements and natural health products.

General manager Minesh Patel says in the company’s seven years of operation GMP has written off less than $100,000 of non-payments, which isn’t much for the amount of business it does.

His $110-million business, which exports to China, among other destinations, has never needed help because the company is managed as a circle of activities so that cash flow is not an issue.

“It’s not just about having good accountants — they can only do their part — but inventory, bargaining and product turnaround all combine to make for good cash flow and [minimal] debt. We try to manage the risk.”

Simon Thomson, business development manager of Commercial Factors and Finance (CAFF) says his company also discounts LCs where the buyer agrees to pay on an agreed date. But there’s still a lag of more than 30 days, whereas factoring puts money in the seller’s pocket in 24 hours.

“We recognise many exporters struggle through lack of cash flow as opposed to lack of profits. Certainly any growing business requires cash to facilitate growth.

“Our clients may elect to use our services on a one-off basis or on a continual basis. We believe our service is not only quick and easy but is fully transparent.”

The newly formed Combined Building Society (including MARAC Finance) has indicated it is pursuing a banking licence, says David Battersby, regional manager, business.

The new entity is already focused on providing cash flow lending and invoice finance solutions to small and medium enterprises, with less emphasis on mortgage security than traditional banks. Cash flow lending will complement its traditional strength in asset financing.

“Consideration of an invoice discounting product for exporters is also under way. Watch this space,” Battersby says. [END]